Bank of America has raised its price target for Apple stock to $320, setting a new high among Wall Street forecasts and signaling strong confidence in the company’s future. This move comes just ahead of Apple’s quarterly earnings report, driven by expected growth in AI, iPhone sales, and new products.

Why Bank of America Sees Big Upside for Apple

Analysts at Bank of America point to Apple’s solid position in artificial intelligence and its expanding product lineup as key reasons for the upgrade. They believe these factors will drive earnings higher over the next few years.

The bank kept its Buy rating on the stock, highlighting Apple’s large customer base and brand power. Projections show revenue could reach $418 billion in fiscal year 2025, with earnings per share at $7.41.

This target suggests a potential 19 percent gain from Apple’s recent closing price around $269. Experts note that AI features in devices like eyewear and smart home tech could boost growth through 2030.

Bank of America also expects Apple’s services business to keep expanding, adding stability amid hardware sales fluctuations.

Strong iPhone Demand Fuels Optimism

Recent sales data shows the iPhone 17 lineup is off to a hot start, outperforming last year’s models. This surge supports the bank’s positive outlook.

Counterpoint Research reports that iPhone 17 sales jumped 14 percent over the iPhone 16 in the first 10 days in key markets like the US and China. The base and Pro models led the way, while the new iPhone Air beat out its predecessor.

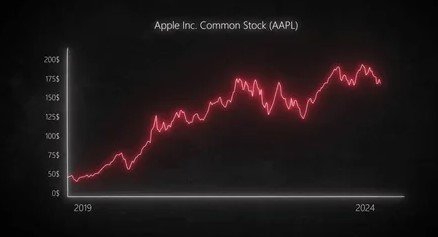

Apple’s stock hit new record highs this week, briefly topping a $4 trillion market cap. This places it among top players like Nvidia and Microsoft in valuation.

Demand for iPhones remains crucial, making up over half of Apple’s total revenue, which hit $391 billion in 2024.

Here are some key factors behind the iPhone success:

- Improved camera features and battery life draw in buyers.

- AI integrations make devices smarter and more appealing.

- Global expansion in emerging markets adds to sales volume.

AI and New Products on the Horizon

Bank of America bets on Apple’s push into AI and innovative gadgets to power long term growth. They see the company as a leader in on device AI, which could change how people use tech.

The bank forecasts earnings could double by 2030, thanks to new offerings like AI augmented eyewear and home robots. These could open fresh revenue streams beyond phones and computers.

However, challenges like shifts in search revenue from AI might arise. Still, Apple’s ecosystem gives it an edge over rivals.

In a recent note, analysts raised their 2027 earnings per share estimate to $9.88, basing the $320 target on a multiple of 32 times that figure.

| Year | Projected Revenue (Billion) | Projected EPS |

|---|---|---|

| 2025 | 418 | 7.41 |

| 2026 | Not specified | 8.40 |

| 2027 | Not specified | 9.88 |

| 2030 | Potential doubling | Not specified |

This table shows Bank of America’s growth expectations, underscoring their faith in Apple’s strategy.

How This Fits into Broader Market Trends

Apple’s story ties into the bigger tech boom, where AI drives stock gains across the sector. Other firms like Microsoft have seen similar lifts from AI bets.

Wall Street’s average price target for Apple sits lower at about $254, making Bank of America’s call stand out. Yet, positive sentiment is building as earnings approach.

The stock rose slightly on the news, reflecting investor excitement. With the earnings report set for Thursday, all eyes are on Apple’s numbers.

Recent events, like strong holiday sales forecasts, add to the momentum. Analysts expect services like Apple TV and Music to contribute more in coming quarters.

What Investors Should Watch Next

As Apple prepares to release its results, focus on iPhone sales and AI updates. These could confirm or challenge the bank’s upbeat view.

Traders should note potential risks, such as supply chain issues or economic slowdowns. Still, Apple’s cash flow and buyback programs provide a safety net.

In the end, this target reflects belief in Apple’s ability to innovate and grow. Share your thoughts on Apple’s future in the comments below, and pass this article along to fellow investors for more discussion.