Vista Equity Partners and Blackstone have quietly pulled off a deal worth talking about. The two investment giants are taking control of Assent, a compliance software company based in Ottawa, in a deal that values the firm at $1.3 billion. No splashy press release. No public fanfare. Just a silent handover of a fast-growing tech firm that helps some of the biggest names in manufacturing stay out of trouble.

Assent, which started nearly two decades ago with three people, now has hundreds of employees and clients across the globe. Its software helps companies track their supply chains to meet increasingly strict environmental, labor, and ethical standards. And as regulatory demands pile up, demand for what Assent does is only climbing.

The stealth approach to a billion-dollar buyout

It’s not every day you see a deal this size go down without noise. But that’s exactly what happened.

The deal was finalized a few weeks ago, according to sources familiar with the matter, though it wasn’t until now that the public even got wind of it. Assent had previously raised around $500 million from investors including Warburg Pincus and the Ontario Teachers’ Pension Plan. Those names are expected to be on their way out as Vista and Blackstone take over.

Why the hush-hush? No one’s saying officially. But sources suggest the quiet move might’ve helped the deal get done without driving up the price or attracting unwanted attention in a heated market.

What makes Assent such a hot target

Assent isn’t your average SaaS company. It’s part of a niche but fast-growing category — compliance software for manufacturers — and it’s one that’s getting more attention lately.

Think about it. Companies everywhere are under pressure to ensure that the materials they use are sourced responsibly. Child labor? Environmental violations? One slip-up can tank a brand. That’s where Assent steps in.

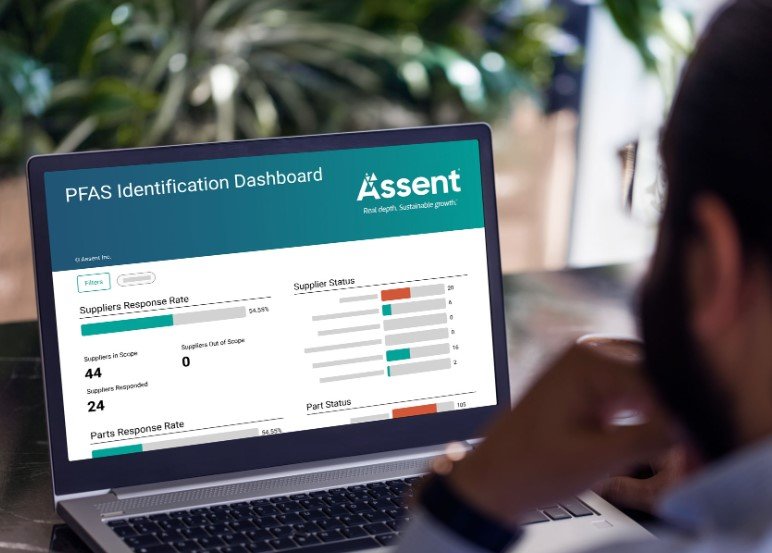

They offer detailed visibility into sprawling supply chains. Their customers — which include some of the world’s biggest manufacturers — use Assent’s platform to collect and verify information from thousands of suppliers. It helps them comply with laws like the U.S. Uyghur Forced Labor Prevention Act, EU regulations, and more.

Assent’s growth over the last five years has been strong, especially as global supply chains became a regulatory minefield. The company said in 2021 it was serving over 1,000 clients. Insiders now say that number is “well above that” — though they’re not giving exact figures.

One person familiar with the deal said it was Assent’s long-term client relationships and low churn rate that sealed the investors’ interest.

Private equity’s deepening tech appetite

The pairing of Vista and Blackstone isn’t surprising if you’ve been watching how private equity is playing tech these days. What is surprising is how rarely you see them tag-team on the same deal.

Vista is no stranger to enterprise software. They’ve snapped up firms like Datto and Apptio. Blackstone’s tech ambitions have also ballooned over the past decade, backing data center firms, cybersecurity, and logistics platforms.

Why Assent now? Because compliance isn’t going away.

One of the insiders put it bluntly: “Companies are terrified of getting it wrong.”

That fear is big business.

-

Environmental regulations are tightening globally

-

Forced labor laws are triggering import bans

-

Companies face fines, lawsuits, and public backlash

The compliance landscape is messy. That creates an opportunity — and Assent’s tech is built to tackle it.

A quiet signal in a noisy market

The deal’s low-profile nature might actually say more than a loud announcement would.

We’re in a moment when tech valuations are jittery. IPO windows are barely cracked open. And strategic buyers are choosier than ever. For Assent, getting a $1.3 billion valuation — with hardly a peep — is a small miracle.

Take a look at the context:

| Company | Sector | Recent Valuation | Year |

|---|---|---|---|

| Assent | Compliance Software | $1.3 billion | 2025 |

| EcoVadis | Sustainability Data | $1.6 billion (est.) | 2023 |

| OneTrust | Privacy Tech | $4.5 billion | 2021 |

| Arctic Wolf | Cybersecurity | $4.3 billion | 2022 |

Assent’s deal doesn’t match the size of some of these peers. But the valuation — especially in 2025’s weird, choppy funding climate — shows strength.

It also sets a new benchmark for Canadian SaaS exits. Very few Canadian tech companies have crossed the billion-dollar finish line in private sales. That includes big names like Shopify, but also others like Benevity and FreshBooks that fell just short.

What happens now?

Leadership at Assent is expected to stay intact for now, though insiders say Vista may bring in some board-level changes. Employees have been informed of the deal. But there’s been no official word from the company yet.

One Assent employee, who asked not to be named, said things were “business as usual — but definitely a bit more polished around here lately.” That usually means one thing: something big just happened.

Sources close to the deal say the company has no immediate plans to go public, but that a public listing in the next two to three years isn’t off the table.

For now, Assent is expected to double down on product and expand its presence in Europe and Asia, where compliance headaches are, frankly, just getting started.