Saudi Arabia’s hiring landscape is tilting toward technology and healthcare, while traditional drivers like construction and oil face a slowdown due to spending adjustments.

The shift comes as parts of the kingdom’s ambitious mega-projects, including NEOM, are resized or pushed back. While these changes are cooling recruitment in engineering-heavy sectors, demand for skilled professionals in digital and medical fields remains strong.

NEOM Timelines and Their Ripple Effect

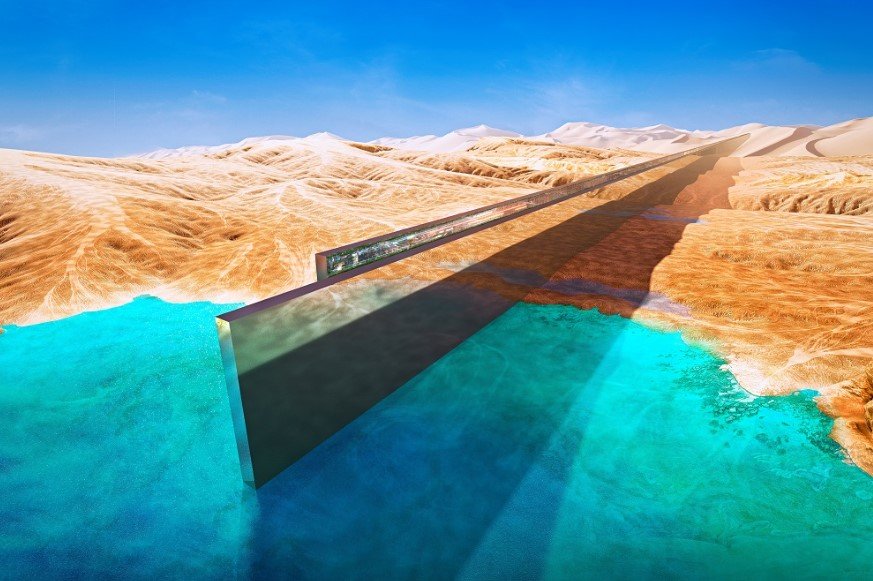

NEOM, the multitrillion-dollar development touted as a centerpiece of Vision 2030, has been under the microscope for months. Officials and contractors alike confirm that certain components—such as sections of “The Line”—have been resized or rescheduled.

That means fewer immediate openings in engineering, design, and large-scale construction management. “In the oil and gas and some large-scale construction projects, hiring was delayed due to adjustments in government spending,” said Anurag Verma, General Manager for Saudi operations at consultancy Innovations Group.

Even for those still employed in these projects, there’s a quieter mood. Projects are still alive, but the pace feels less frenetic than two years ago.

Some insiders see this as a recalibration rather than a collapse. Others note that delays in such headline developments can send a chill across the entire supply chain.

Hiring Patterns Show a Sector Split

The latest market signals point to a widening gap between sectors gaining momentum and those losing steam.

In the winners’ column:

-

Information technology firms recruiting for AI specialists, cybersecurity analysts, and cloud engineers.

-

Healthcare providers adding doctors, nurses, and hospital administrators to meet rising demand from a growing population.

On the slower side: oil, gas, and construction—traditionally some of the country’s largest employers.

Recruitment agencies say the data is clear. In the first half of 2025, tech and healthcare job postings grew steadily, while listings for civil engineers, project managers, and drilling specialists dipped.

One recruiter put it bluntly: “Right now, a software developer might have more options in Riyadh than a civil engineer.”

Why Tech and Healthcare Are Holding Strong

It’s not just a fad. Saudi Arabia’s Vision 2030 blueprint has placed tech and healthcare at the center of its diversification strategy.

Digital transformation projects—from smart city systems to government service platforms—are rolling out fast. Healthcare reforms, including expanded insurance coverage and new private hospital openings, are creating steady demand for talent.

There’s also a demographic push. The kingdom’s median age is under 30, meaning more tech-savvy citizens entering the workforce, while an ageing segment of the population is driving up healthcare usage.

A Ministry of Health report earlier this year projected a 15% increase in demand for medical specialists by 2030. Tech forecasts are even more aggressive, with IT spending in Saudi Arabia expected to top $20 billion annually by 2026, according to IDC.

Construction Sector Faces a Different Reality

Construction’s slowdown is more about timing than long-term decline, experts say.

NEOM’s reshaped schedules, along with budget re-prioritisation for other giga-projects, are creating short-term uncertainty. This has ripple effects: fewer tenders being issued, reduced subcontractor hiring, and paused procurement for large material orders.

Some contractors have shifted staff to smaller-scale developments in housing and infrastructure, but these don’t absorb the same volume of engineers and technicians as mega-projects.

One project manager described it as “waiting for the tap to turn back on.”

| Sector | Hiring Trend (2025 H1) | Key Drivers |

|---|---|---|

| Technology | Increasing | Digital transformation, AI adoption |

| Healthcare | Increasing | Population growth, healthcare reforms |

| Construction | Decreasing | Project delays, budget adjustments |

| Oil & Gas | Decreasing | Delayed investments, spending review |

Oil and Gas: Slowed by Spending Adjustments

The oil and gas industry is feeling a similar pinch.

While global demand remains strong, Saudi Arabia’s public spending review has meant certain exploration and infrastructure projects are on hold. Delays in greenlighting new drilling or refinery expansions directly reduce hiring for engineers, geologists, and skilled trades.

It’s a reminder that even in a hydrocarbon powerhouse, fiscal discipline can overrule short-term recruitment needs.

Some analysts suggest this could change quickly if energy prices rise and government revenue surpluses expand. But for now, the hiring mood in oil towns is cautious.

What It Means for Job Seekers

For Saudis and expatriates alike, the message is clear: opportunities are still there, but they’re not evenly spread.

Tech professionals with cloud, AI, and cybersecurity skills are seeing steady offers. Medical practitioners—especially specialists—remain in demand.

Those in construction and oil may need to consider short-term shifts into adjacent fields, or be prepared for slower hiring cycles until major projects regain pace.

Recruiters say flexibility is becoming as valuable as experience. Being open to contract roles, relocation within the kingdom, or cross-sector moves could be the difference between a quick placement and months of waiting.