In a surprising revelation, an investor has highlighted a key statistic that could signal a bright future for Nvidia Corporation. According to Yuri Khodjamirian, the Chief Investment Officer at Tema ETFs, Nvidia’s projected free cash flow (FCF) for 2026 is expected to surpass that of Microsoft Corporation. Wall Street analysts predict Nvidia’s FCF to reach $78.7 billion and $91.1 billion in the 2025 and 2026 financial years, respectively. This projection has left many investors and analysts astounded, as it positions Nvidia to become the highest in the world in terms of cash flow.

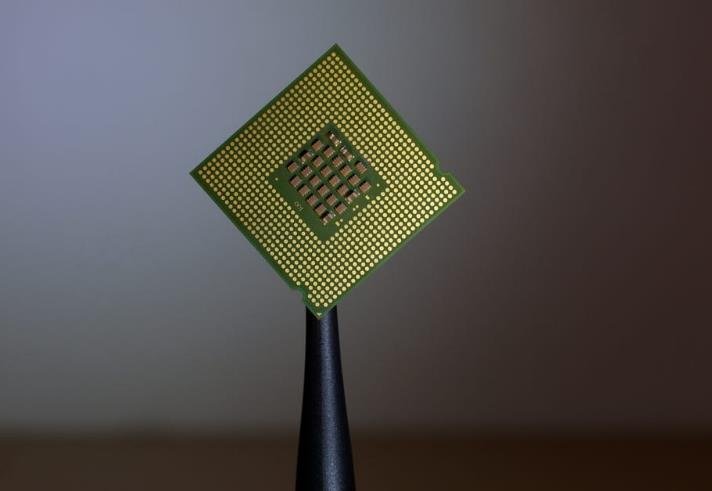

Nvidia’s remarkable growth can be attributed to its dominance in the artificial intelligence (AI) and semiconductor markets. The company’s AI chips, particularly the H100 processor, have seen unprecedented demand from major software companies like Microsoft, Amazon, and Alphabet. This surge in demand has driven Nvidia’s value past Apple, making it the world’s second-most valuable company. The H100 processor’s popularity is so high that some customers face a six-month wait to receive it, underscoring its significant impact on the industry.

The company’s CEO, Jensen Huang, has played a pivotal role in steering Nvidia towards this success. Under his leadership, Nvidia has consistently outpaced its competitors with annual product announcements that continue to push the boundaries of technology. This relentless innovation has solidified Nvidia’s position as a leader in the tech industry and has fueled its impressive financial performance.

Investor Confidence

The projection of Nvidia’s future cash flow has instilled confidence among investors and analysts. Anthony Ginsberg, CEO of Gins Global, emphasized the importance of AI in accelerating the adoption of cloud services. He noted that a substantial portion of IT spending in America is focused on the cloud, and companies without an AI mission risk falling behind. Ginsberg predicts that Fortune 500 companies will increasingly outsource their AI and algorithmic business to cloud service providers, benefiting companies like Google Cloud and Microsoft Cloud.

Khodjamirian’s revelation about Nvidia’s projected cash flow has further bolstered investor confidence. He believes that Nvidia’s fundamentals are strong, and the company’s annual product announcements give it a competitive edge. Despite concerns about the uncertainty of AI software revenue, Khodjamirian remains optimistic about Nvidia’s long-term success.

The Future of Nvidia

Looking ahead, Nvidia’s future appears promising. The company’s strategic focus on AI and cloud computing positions it to capitalize on the growing demand for these technologies. Nvidia’s chips have become essential for tech companies and industries worldwide, driving its growth and solidifying its role in the tech infrastructure.

As Nvidia continues to innovate and expand its product offerings, it is well-positioned to surpass Microsoft in terms of cash flow. This milestone would mark a significant achievement for the company and further establish its dominance in the tech industry. Investors and analysts will be closely watching Nvidia’s performance in the coming years, as the company continues to push the boundaries of technology and redefine the future of AI and cloud computing.