Google Pay officially launched in the Philippines on November 18, 2025, marking a major step for digital payments in the country. This rollout partners with nine banks and fintech firms, letting users make contactless payments through Android devices at stores with NFC terminals.

What the Launch Means for Users

Filipinos can now add their debit and credit cards to Google Wallet for easy tap-to-pay options. This service boosts convenience for everyday shopping, from groceries to public transport.

Many people have waited for this global wallet to arrive. It joins local apps like GCash and Maya, but brings Google’s secure tech to more users.

The launch comes at a time when digital payments are surging in the Philippines. Recent data shows over 70 percent of adults now use some form of e-wallet, up from 50 percent just two years ago.

This growth ties into the central bank’s push for a cash-light society. By 2025, experts predict digital transactions could hit 50 percent of all retail payments.

List of Supported Banks and Cards

The initial rollout includes a mix of traditional banks and fintech players. Each offers specific card types for Google Pay.

Here is a breakdown of the partners:

- China Bank: Mastercard credit and Visa credit or debit cards

- East West Bank: Mastercard and Visa credit cards

- GCash: Mastercard debit cards

- GoTyme Bank: Visa debit cards

- Maya Bank: Visa credit cards

- RCBC: Mastercard and Visa credit cards

- UnionBank: Visa cards

- Wise Philippines: Visa prepaid cards

- Zed Financial PH: Mastercard credit cards

These options cover a wide range of users, from everyday debit holders to credit card enthusiasts.

Not all major banks joined right away. Sources indicate bigger players like BDO Unibank and BPI are still working on tech setups.

How Google Pay Works in Daily Life

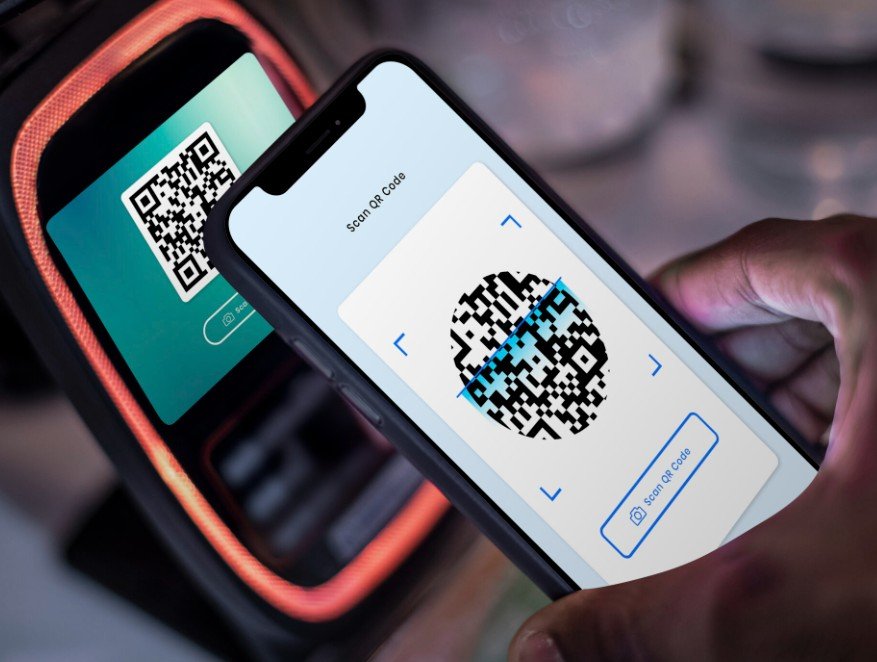

Setting up is simple for Android users. Download the Google Wallet app, add your card details, and verify with your bank.

Once set, tap your phone at any NFC-enabled point-of-sale terminal. Security features like tokenization protect your card info, replacing it with a unique code for each transaction.

This tech reduces fraud risks, which is crucial in a country where cyber threats have risen 20 percent in the past year.

Users can also track spending and get notifications. For travelers, it links well with international payments, making it handy for overseas Filipinos.

In stores, it speeds up checkout lines. Imagine paying for coffee or jeepney fares without fumbling for cash.

Regulatory Green Light and Tech Hurdles

The Bangko Sentral ng Pilipinas gave the go-ahead without requiring Google Pay to register as a payment provider. Officials see it as a tech service that does not handle funds directly.

This decision clears the path for more global players. It reflects the government’s support for fintech innovation to drive financial inclusion.

Banks faced challenges like tokenization to integrate. This process ensures safe data sharing between Google and issuers.

Experts note that full adoption could take months. Smaller banks moved faster, while larger ones finalize systems.

| Bank/Fintech | Card Types Supported | Launch Status |

|---|---|---|

| China Bank | Mastercard credit, Visa credit/debit | Live |

| East West Bank | Mastercard/Visa credit | Live |

| GCash | Mastercard debit | Live |

| GoTyme Bank | Visa debit | Live |

| Maya Bank | Visa credit | Live |

| RCBC | Mastercard/Visa credit | Live |

| UnionBank | Visa cards | Live |

| Wise Philippines | Visa prepaid | Live |

| Zed Financial PH | Mastercard credit | Live |

This table shows the current setup, based on the latest updates.

Broader Impact on the Economy

Digital wallets like Google Pay could transform small businesses. Merchants with NFC terminals see faster transactions and lower cash handling costs.

In rural areas, where banking access is limited, this expands options. Over 40 million unbanked Filipinos might benefit, according to recent studies.

It also aligns with regional trends. Neighboring countries like Singapore and Thailand have similar systems, easing cross-border trade.

Competition heats up with local giants. GCash, with 90 million users, now integrates directly, potentially growing its reach.

Looking Ahead to Expansions

More banks plan to join soon. Reports suggest BPI aims for support by 2026, with others following.

Google might add features like loyalty cards or bill payments. This could make it a one-stop app for finances.

Users should watch for updates in the app. As adoption grows, expect promotions from banks to encourage sign-ups.

The launch positions the Philippines as a fintech hub in Southeast Asia. With rising smartphone use, digital payments are set to boom.

What do you think about Google Pay in the Philippines? Share your thoughts in the comments and spread the word to friends who might benefit from this new option.