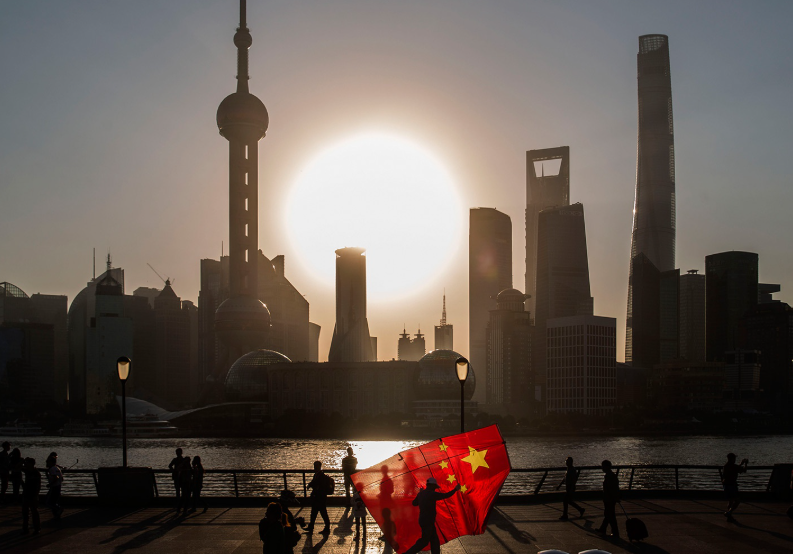

Financial giants are warming up to China again. After a sudden trade thaw with the U.S., global investment banks are revising their China forecasts—upwards. For a country that’s been stuck in the mud of sluggish recovery, this shift is catching eyes.

On Monday, Beijing and Washington pulled back from a costly tariff war, agreeing to slash tariffs for 90 days. It’s a pause, not a peace treaty—but it’s enough to change the math for global investors.

A 90-Day Reprieve Sends Forecasts Climbing

It’s not often that a few percentage points in tariffs can shake global strategy desks. But this time? The impact has been immediate.

UBS, among the first to react, now pegs China’s 2025 GDP growth at somewhere between 3.7% and 4%. Just a few days ago, they were calling for 3.4%. That’s a meaningful bump, especially in a country where momentum has been elusive.

Morgan Stanley wasn’t far behind. Their economists say the second quarter could now clock in above 4.5% GDP growth—driven in part by exporters racing to move goods before the 90-day window shuts.

The optimism is cautious, but real.

ANZ Bank, which recently downgraded its 2025 China forecast from 4.8% to 4.2%, is already reconsidering that move. The new trade landscape could help China edge closer to its previously loftier goals.

What’s Actually in the Deal?

So, what changed overnight? A 90-day suspension of most tariffs.

Before Monday, tariffs on goods traded between the U.S. and China were as high as 125%. That’s now been trimmed down to just 10%. It’s a dramatic rollback—albeit temporary.

This reversal comes barely a month after former President Donald Trump’s “reciprocal” tariff spree on April 2 rattled global markets and dragged down forecasts across the board.

Now, with tensions cooling (at least on paper), the landscape looks different.

-

U.S. and China agree to slash mutual tariffs from 125% to 10%

-

The deal holds for 90 days, with reassessment talks scheduled thereafter

-

Exporters on both sides are scrambling to make the most of it

This is no sweeping solution. But for market watchers and business leaders, it’s a window of calm in what’s been a very choppy year.

Stocks, Sentiment, and Second Thoughts

Markets have responded with their usual fickle enthusiasm.

Chinese equities got a modest lift on Tuesday. The Hang Seng China Enterprises Index gained 1.6% in early trade, with export-heavy sectors like manufacturing and logistics leading the charge.

But not everyone’s cheering.

“There’s relief, yes. But you can’t build a 10-year plan around a 90-day break,” one Shanghai-based fund manager told us, requesting anonymity due to regulatory constraints.

In a world where trade rules seem to change with a tweet—or a press release—skepticism isn’t exactly surprising.

Still, sentiment has shifted, and that alone matters.

Table: Revised China GDP Forecasts Post-Tariff Deal

| Institution | Previous Forecast (2025) | Revised Forecast (2025) | Notable Notes |

|---|---|---|---|

| UBS | 3.4% | 3.7% – 4.0% | “Smaller shock” from tariff relief |

| Morgan Stanley | ~4.0% | Q2 > 4.5%, Q3 > 4.0% | Exports likely front-loaded during suspension period |

| ANZ Bank | 4.2% (down from 4.8%) | Could revise upward | Earlier downgrade might be “premature” given new dynamics |

Don’t Break Out the Champagne Just Yet

The 90-day window is short. It buys time—nothing more.

Several analysts have raised a red flag about calling this a turning point. There’s still no long-term framework in place. Trade reps haven’t announced new talks. And underlying issues—intellectual property, tech access, national security—remain untouched.

One Beijing-based economist summed it up with a shrug: “It’s more of a timeout than a truce.”

In fact, some believe the short-term relief could lead to a kind of false euphoria that papers over deeper problems. Especially in real estate and local government debt—sectors that have far more to do with China’s long-term economic health than tariffs alone.

A Boost for Business, But for How Long?

Still, for Chinese exporters, this is a break they badly needed.

The past few months have seen dwindling overseas orders, margin squeezes, and unpredictable policy swings. Now, with just 10% tariffs in place, businesses are rushing to fill orders and ship out stock.

It’s a scramble—but a profitable one.

And it’s not just exporters. Logistics, warehousing, and even e-commerce platforms are feeling the ripple effects.

“This gives us some breathing room,” said one Shenzhen-based electronics supplier. “We’re booking containers like it’s 2019 again.”

But they’re also hedging bets. Many companies are already preparing for what happens on Day 91.

Politics, Pressure, and a Sense of Déjà Vu

There’s also a political calculus here—on both sides.

For China, stabilizing trade and attracting foreign investment remains a top priority as it tries to hit its 5% annual growth target. A renewed spat with the U.S. could derail that plan entirely.

For the U.S., the deal offers inflation relief, particularly on consumer goods. With elections around the corner, that’s no small incentive.

Yet, if this feels familiar—it’s because we’ve seen it before. Temporary tariff suspensions were a hallmark of the previous U.S.-China trade saga in 2019. Those fizzled out. Some fear history may repeat itself.